Do You Need A Bank Account For Bitcoin

- Do You Need A Bank Account For Bitcoin Instantly

- Do You Need A Bank Account For Bitcoin Account

- Do You Have To Have A Bank Account For Bitcoin

If you're buying Bitcoin for the first time, Binance and Coinbase offer education and all of the tools that you need to get started. Exchanges charge commissions—transaction fees for credit cards, debit cards, and bank transfers—as well as markups on Bitcoin to U.S. Dollar conversions. No you do not need a Bank Account To Mine Bitcoins. You Will Only Need a Bank Account To Buy The Equipment You Will Use To Mine The Bitcoins ☺️. Today you need an ASIC – a machine specially designed and built just for Mining Bitcoin. °ASIC° stands for ‘Application Specific Integrated Circuit'.

Key Takeaways

What is bitcoin? What do you need to invest in bitcoin How to invest in bitcoin in 4 steps Is bitcoin a good investment Different ways to invest in bitcoin

Over the last several years, you’ve probably seen “Bitcoin” suggested as a cutting-edge investment option. There’s been a lot of debate about Bitcoin and other cryptocurrencies, its proponents arguing that it’s the future of currency and investing, while its detractors argue that it’s a risky investment option that may not generate big returns.

What exactly is Bitcoin, and how can you determine whether it’s the right investment for you? Read this beginner’s guide on how to invest in Bitcoin.

What is Bitcoin?

Bitcoin was created by a programmer or group of programmers using the name, “Satoshi Nakamoto.” But the real creator(s) of Bitcoin is still unknown to the public.

Bitcoin is one of the most widely used types of cryptocurrency. In a cryptocurrency system, virtual “coins” or “tokens” are used instead of physical cash. Coins have no intrinsic value and they aren’t backed up by gold or silver.

Bitcoin was created to solve a couple of big cryptocurrency flaws. First, it was designed to prevent crypto coins from being fraudulently duplicated. Think about how easy it is to make copies of the data on your computer—documents, photos, files, etc. Cryptocurrency wouldn’t be possible if anybody could just duplicate a coin and create an unlimited amount of currency for oneself. You can’t just make copies of a $20 bill, right? Likewise, there’s a need to prevent people from reproducing crypto coins.

[ Interested in diversifying your investment portfolio beyond the stock market? Register for our FREE online real estate class to learn why real estate investing is the perfect compliment to any portfolio. ]

Bitcoin uses a digital technology called “blockchain,” which is an advanced coding mechanism that disperses a single code over thousands of different computers. For example, let’s say that your coin is built from the code, “XDA146DDS.” Blockchain segments the code into smaller pieces and stores the pieces of code across many computers. If a hacker wanted to gain access to the code, they’d have to hack a variety of different computers to access the entire code.

Blockchain also employs a “public ledger,” which uses thousands of computers (referred to as “nodes”) to keep track of coins and their owners. If a coin’s data is changed, the nodes will cross-reference each other’s records to verify whether the change is accurate and that it was initiated by the coin’s owner.

So, you might be asking, what is Bitcoin used for?

Once you purchase coins, you can use them in online transactions wherever they’re accepted. Remember, when you make a transaction with a coin, there’s no actual money being pulled from your bank account. Money only leaves your bank account when you purchase the coin itself—not when you make purchases with a coin.

Like cash currency, the value of a coin may fluctuate. That’s why some investors are getting excited about Bitcoin and other types of cryptocurrency. Investors speculate that the value of Bitcoin coins may rise significantly if there’s a surge in the market. I’ll explain the arguments for and against cryptocurrency investment later on.

What Do You Need to Invest in Bitcoin?

You don’t need very much to invest in Bitcoin! You only need your:

Personal identification documents

Bank account information

A secure internet connection

If you’re going to be purchasing coins through a stockbroker, you may not need to supply your personal information or financial information because your stockbroker will likely have all that on record.

How to Invest in Bitcoin in 4 Steps

Here’s how to invest in Bitcoin, in 4 easy steps.

1. Join a Bitcoin Exchange

First, you’ll need to determine where you want to make a Bitcoin purchase. Most Bitcoin investors use cryptocurrency exchanges. There’s no official “Bitcoin” company because it’s an open-source technology, but there are several different exchanges that facilitate Bitcoin transactions. These exchanges are the middlemen of cryptocurrency investing, like a stock brokerage.

If you decide to purchase from an exchange, you’ll have to decide which exchange you want to buy from. Here are a few of the most popular options:

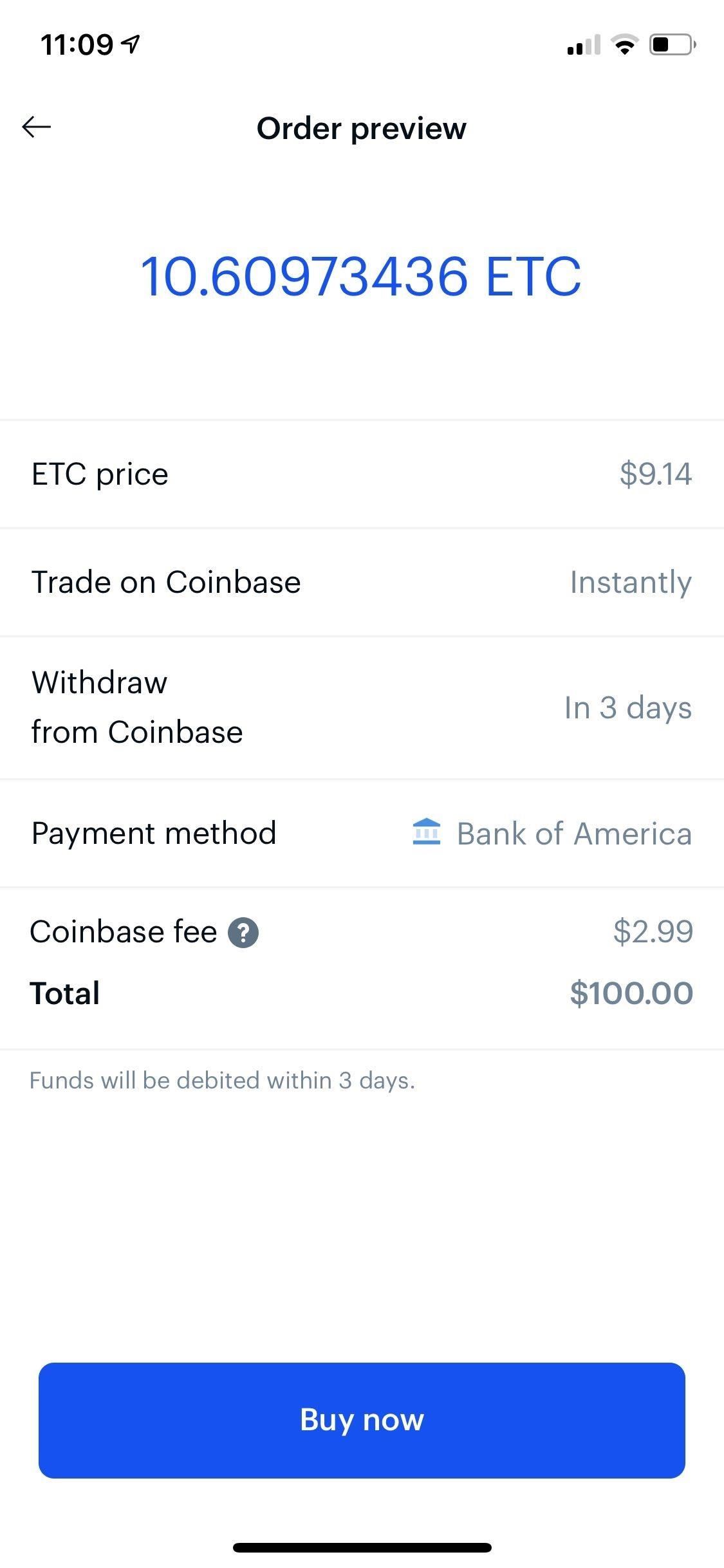

Coinbase: A very popular crypto exchange that insures losses in the event of a security breach or fraudulent transfers

Bitfinex: The longest-running cryptocurrency exchange that’s optimized for advanced traders and lenders (unfortunately, Bitfinex doesn’t currently accept US customers)

Strategize the strengths and weaknesses of the company.

2. Get a Bitcoin Wallet

When you purchase a coin, it’s stored in a “wallet,” which is where all your cryptocurrency is stored. There are two types of wallets you can get: a “hot wallet” or a “cold wallet.”

A hot wallet is a wallet that’s operated by either your cryptocurrency exchange or by a provider. Some exchanges will automatically provide you with a hot wallet when you open your account. In any case, hot wallets are convenient because you’ll be able to access your coins through the internet or a software program.

Some notable hot wallets are:

Electrum: Software that enables you to store your coins on your computer

Mycelium: A mobile-only app for Android and iPhone users

However, hot wallets are not the most secure form of coin storage. If the hot wallet provider is hacked, then your coin information may be at risk.

A cold wallet is the safest storage method for your coins. A cold wallet is an actual piece of hardware that stores your coins, usually, a portable device that’s similar to a flash drive. Most cold wallets cost between $60 to $100. Some popular cold wallets are:

Trezor

Ledger Nano

If you’re only going to purchase small amounts of coin, then you might be fine using a hot wallet with an insured crypto exchange. But if you’re going to be trading large amounts of coin, then a cold wallet would be well worth your investment.

3. Connect Your Wallet to a Bank Account

When you’ve obtained your wallet, you’ll need to link it to your bank account. This enables you to purchase coins and sell coins. Alternatively, your bank account may be linked to your cryptocurrency exchange account.

4. Place Your Bitcoin Order

Now you’re ready to purchase bitcoin. Your cryptocurrency exchange will have everything you need to buy. The big question is, how much bitcoin should you purchase?

Some coins cost thousands of dollars, but exchanges often allow you to buy fractions of a single coin—your initial investment could be as low as $25.

Investing in bitcoin is very risky, and it’s important that you carefully determine your risk tolerance and review your investment strategy before you purchase any bitcoin. We’ll go over this in the next section.

5. Manage Your Bitcoin Investments

After you’ve purchased bitcoin, you can:

Use your coins to make online transactions

Hold your coins for a long period in the hopes it’ll appreciate in value

Perform day trading with your coins—that is, buying and selling coins with other bitcoin owners, which can be facilitated on the cryptocurrency exchange

Your cryptocurrency exchange will provide you with everything you need to buy and sell coins.

Is Bitcoin a Good Investment?

Here’s one of the most commonly asked questions about bitcoin: is bitcoin a good investment?

Well, no investment is truly “good” or “bad.” It depends entirely on your risk tolerance, your investment strategy, and your financial goals. Before you consider bitcoin as an investment, you should carefully consider your own goals and determine what you want to accomplish in your investment activities. Do you want to develop a passive income? Become a full-time investor? Save for retirement? Answering these questions will help you figure out whether bitcoin is the right investment option for you.

Bitcoin is a very high-risk investment because it’s a volatile asset. That means that bitcoin values may rise or fall dramatically in value over a very short period—even as quickly as a few hours or days.

Like all cryptocurrencies, bitcoin has no intrinsic value. It’s not backed by any physical asset, like gold or silver, and there’s no central regulator to ensure that the value remains stable. Furthermore, bitcoin value isn’t linked to the profits of any one corporation. The value of bitcoin is dependent on market demand. When there are more people buying bitcoin, the value will increase. When there are fewer people buying bitcoin, the value will decrease.

To make a significant profit on bitcoin, you may need to rely on “timing the market,” which is a difficult and generally ill-advised investment strategy. Nonetheless, there’s a potential for profit.

The Pros of Bitcoin Investing

The main benefit to bitcoin investing is that you may be able to generate a huge return on profit, perhaps as high as 200% or more. Of course, that’s an extremely difficult thing to accomplish, but it’s possible.

If you purchase a large amount of bitcoin, you may be able to capitalize on a market surge and sell your coins for a much higher value when there are lots of buyers. There’s also a slight possibility that bitcoin will truly become the currency of the future, or a more popularly-traded asset, and you could hopefully generate returns from long-term holdings. It should be noted, however, that bitcoin values are generally decreasing every year.

Your success may depend on properly “timing the market.” In other words, you’ll buy coins when they’re at a low price and sell them when they’re at highest possible price. High-risk investors who pay close attention to the market may be able to generate massive returns when employing that strategy. They might even generate returns that are highly improbable in the world of corporate stocks or government bonds.

The Cons of Bitcoin Investing

Unfortunately, the high volatility of bitcoin makes it an incredibly risky investment, and you could lose money if you’re not careful.

Bitcoin and other types of cryptocurrency are at high risk of “pump-and-dump” schemes. Predatory investors will reach out to amateur or unassuming investors and convince them to pour a lot of money into bitcoin. The resulting surge causes bitcoin prices to increase rapidly.

The predatory investors are smart and they sell all of their holdings before the buying surge ends, making a huge profit. But when investors stop buying, the value of the coins falls to extremely low prices. A coin bought for $200 could wind up having a valuation of just $30. The unknowing investors would be throwing their money away.

You could always make a profit by selling your coins before the price collapses, but it’s impossible to predict when the buying surge is going to stop—prices could fall 50% in only a matter of hours. That’s why any volatile asset, like cryptocurrency and penny stocks, are considered high-risk investments.

You should also know that pump-and-dump schemes and pyramid schemes are illegal. While it’s not necessarily illegal to capitalize on a market surge—whether it’s natural or artificially-created—you might not want to be associated with such practices. You could possibly be the target of an IRS audit or a criminal investigation, even if you’ve done nothing wrong.

Different Ways to Invest in Bitcoin

You can invest in bitcoin without actually purchasing any cryptocurrency. There are two different methods.

First, you can invest in a company that utilizes bitcoin technology. Although bitcoin is a risky investment, there are plenty of companies that are selling successful products that incorporate bitcoin and blockchain technologies. You can find several exchange-traded funds (ETFs) that include shares from a variety of blockchain-related companies, like the Amplify Transformational Data Sharing ETF (BLOK). You’re not directly investing in cryptocurrency but in corporate stocks of companies that utilize bitcoin. It’s safer and most ETFs in this category outperform the market.

Second, you can participate in bitcoin mining. Bitcoin mining is simply allowing your computer to be used as a node for the public ledger. It’s a topic that’s worthy of its own blog post, but you should know that bitcoin miners are rewarded with actual bitcoin for their contributions. You could receive free bitcoin without actually ever purchasing it.

Bitcoin Investment Strategies

If you do decide that you want to try bitcoin investing, be sure to heed the following tips:

Understand your risk tolerance: As mentioned before, bitcoin is a high-risk investment and you should carefully review your risk tolerance before you invest. If you don’t feel comfortable investing in volatile assets, or if you only have a small sum of money to invest, you may want to consider other investment options.

Diversify Your Portfolio: The best way to protect yourself from investment losses is to diversify your investment portfolio. Your primary investments should be low-risk, like government bonds or index funds. Next, you should go for medium-risk investments, like real estate or corporate stocks. High-risk investments, like penny stocks or bitcoin, should be your smallest and least-prioritized investments. Bitcoin is essentially the “icing on the cake:” the investment that could yield substantial profit, but which you could still do fine without.

Summary

Bitcoin is a popular type of cryptocurrency that utilizes a large chain of interconnected computers to store and protect your digital assets. Bitcoin is a highly volatile asset that’s prone to large and fast swings in value, which presents an opportunity for large returns but also poses a tremendous risk. If you’re going to invest in bitcoin, be sure to diversify your investment portfolio to protect yourself from the marketplace volatility.

Ready to diversify your investment portfolio beyond cryptocurrencies?

Cryptocurrencies like Bitcoin and Ethereum can be lucrative investments with the proper execution, but there is no denying the risks. Investing in real estate is a great way to balance out this risk while achieving financial freedom. Learn how to get started in our new online real estate class hosted by expert investor, Than Merrill.

So if you want to learn more about real estate investing, Click here to register for our FREE 1-Day Real Estate Webinar and get started learning how to invest in today’s real estate market!

Every so often at Coinmama, we get a question that makes us scratch our heads, rethink how we explain things, and go back to Bitcoin basics. Recently that question was “Can you tell me how to transfer Bitcoin to bank account?”

Experienced cryptocurrency buyers will know that the answer to that question is, “You can’t.” And while, sure, it’s tempting to leave it at that, we’re Coinmama, this is a family, and we’re not going to act like a sullen teenager! Nope, like a good Coinmama, we’ll do our best to unpack the question, figure out what’s really being asked, and how to answer the impossible.

Do You Need A Bank Account For Bitcoin Instantly

A short history of Bitcoin

Let’s back up and take a minute to look at why you can’t simply transfer Bitcoin to your bank account. After all, if you’re in possession of a foreign currency, you can go to your bank branch and deposit it into your account at the current exchange rate. So why not Bitcoin?

The answer to this goes back to the origins of cryptocurrency as a decentralized currency. In 2008, in the wake of the financial crisis and with the banks on the brink of collapse, people were becoming distrustful of the banking system and wanted more control over their own economy. It was becoming more and more apparent that there was a need for a currency that wasn’t controlled by a central bank. Out of that need, Bitcoin was born as a decentralized global currency, one that was peer-maintained and eliminated the middle man, one that provided transparency. A currency that was different from other currencies.

In other words, Bitcoin was developed to exist outside of the banking system as we know it. So while it still functions the same way as a traditional fiat currency, it isn’t one. And because of that, you can’t simply transfer the Bitcoin you hold to your bank account. Why? Because even though it exists in tandem with fiat currencies, putting Bitcoin into the centralized banking system would be antithetical to its intent.

We are living in a material world…

Despite your interest in the financial revolution, you’re still living in a world that largely depends on fiat. After all, most landlords (and coffee shops) aren’t accepting Bitcoin for payment yet. So what happens if you’re in possession of a virtual handful of Bitcoins? Where do you store them? How do you use them? And if you’re not yet in possession of them, how to you buy those Bitcoins we speak of? There are so many questions! If you’re asking how to transfer Bitcoin to your bank account, you’re probably really asking one of those questions. Fret not! Coinmama has answers!

How to store Bitcoin: You can’t transfer Bitcoin to your bank account, but you still need to store it somehow. Before you buy Bitcoin, you need to set up a wallet that’s just for cryptocurrency. It is, in many ways, your Bitcoin bank account. There are wallets that are better for everyday crypto use, and there are wallets that are better for housing large sums that won’t be touched for a while. Many people even have more than one wallet—think of it as your checking and savings accounts for cryptocurrency!

Do You Need A Bank Account For Bitcoin Account

How to use Bitcoin: While the ability to use Bitcoin as an everyday currency still isn’t widespread, it’s becoming more and more available. Many online retailers as well as some brick and mortar stores make paying with Bitcoin as easy as scanning a QR code. In other words, trade in your debit card for your wallet app—no bank account needed!

Do You Have To Have A Bank Account For Bitcoin

Of course, neither storing nor using Bitcoin is relevant if you don’t already have Bitcoin. Luckily, while we may not be able to help you transfer Bitcoin to your bank account, if you still need to buy Bitcoin, Coinmama makes that part easy.